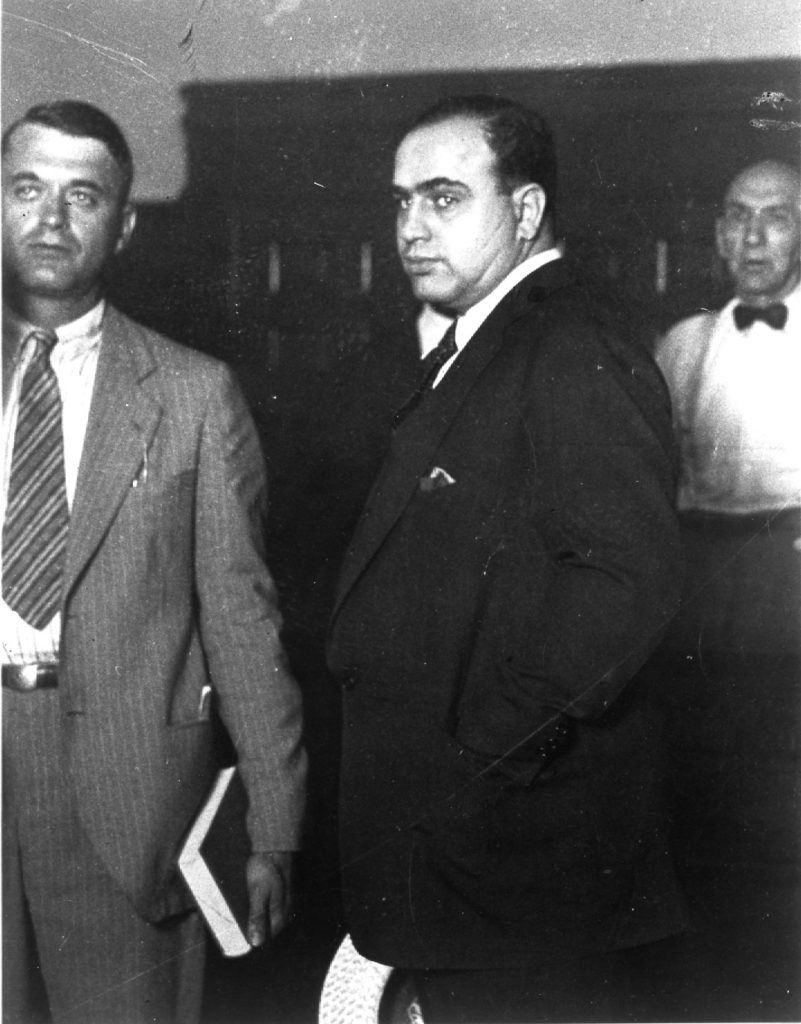

Capone tax evasion trial: Jury finds Chicago mobster guilty on 5 of 23 counts

Part 2: Judge slaps Capone with heavy sentence for tax violations

Last of two parts.

On October 10, 1931, a Saturday, the prosecution read into the record Al Capone’s admissions to spending $200 to $250 a week in Miami on meat, $3 to $4 a day on bread and cake, $21,550 on furniture and $6,180 on suits in 1925, as well as $3,160 on a Columbus Day party and $4,925 on a Kentucky Derby shindig, both in 1926. His phone bill in Miami totaled $3,141 for 1929 (about $56,500 today). Meanwhile, he sent $15,600 to his church in 1926 and $58,000 to a police and widow’s fund in 1925. Capone also paid $40,000 for his estate at Palm Island, Florida (put in his name of his wife, Mae), and made $100,000 worth of improvements, including a $4,000 swimming pool. He also forked over $12,500 for a specially built automobile.

As the prosecution ended the half-day Saturday hearing, a sudden incident drew everyone’s attention. Federal tax agents grabbed and detained Phil D’Andrea, Capone’s intimidating bodyguard, who attended each hearing. D’Andrea was detained inside a back room after Treasury agent Mike Malone noticed the outline of a gun in his coat. Officers removed a loaded .38-caliber pistol and loose ammo from his person. D’Angelo argued that he held a court bailiff permit for the weapon. However, it had recently expired. Judge Wilkerson ordered D’Angelo jailed without bail, and he remained jailed throughout the trial.

On October 12, as Capone sat chuckling nervously with others in the courtroom, the jury heard testimony that the crime boss paid $12 each for pairs of glove-silk underwear (around $215 apiece today), favored $18 to $27 monogramed shirts, sterling silver dinner sets, and that his favorite colors for furniture included canary and green. In 1927, he spent $401 (more than $7,200 in 2021) on neckties and handkerchiefs. For Christmas one year, he bought 30 diamond-encrusted gold belt buckles for his friends. Witnesses from Chicago’s Marshall Field & Company department store said that from 1927 to 1928, Capone went on shopping sprees, laying out $3,715 for 23 suits, three topcoats and an overcoat, and spent more than $1,300 on 35 tailored and monogramed shirts.

One journalist covering the trial, Meyer Berger, wrote that information on Capone’s lavish tastes “was too much for [the] rural gentlemen” of the jury who were “of simple and rather careless habits of dress” and “look like men who would have no use for Chinese rugs and wouldn’t feel right in canary chairs and green rockers. One of them spanned his forehead with a tired hand, as if dazed by it all.”

The so-called “star” witness for the prosecution was Fred Ries, ex-cash handler for Capone’s Subway, Hawthorne and Radio gambling houses. The government had Ries hide out in South America before his appearance for security reasons. He testified about writing cashier’s checks to “J.C. Dunbar,” a fake name he used to cash them to himself at a bank. In 1927, the checks totaled about $150,000, equal to profits at Capone’s Cicero gambling joints. Capone henchman Jake Guzik had received the checks. Prosecutors entered the canceled checks into evidence.

Ries helped the government’s case by implying that Capone’s hidden hand at running the gaming dens. He said Al’s brother Ralph hired the gambling club’s managers and that Guzik bade him not to hand over cash to “anybody besides himself and the man he would send for it, not even Al.”

The defense then got Ries to admit he never saw Capone take any of the cash or even handle money or accept any wagers when he saw the gangster at the Ship, Hawthorne and Radio.

Then on October 13, while the subpoenaed Johnny Torrio and reputed Capone partner Louis La Cava waited outside the courtroom, the prosecution surprised observers by resting its case, believing to have proven it. Capone’s lawyers immediately argued that they had not done so, had not provided enough evidence for conviction, and moved for the judge to order a direct acquittal. Wilkerson, by implication agreeing that the prosecution had submitted sufficient evidence, declined the request and instructed the defense to either present its case or provide a final argument to the jury.

Capone’s side started its case on October 14. Coincidentally, the Hollywood actor Edward G. Robinson, whose hit film Little Caesar, in which he played a Capone-like gang chief, was in theaters, showed up among the spectators permitted in the courtroom. One reporter wrote with irony that Robinson apparently came by “to give Snorky [Capone] a few pointers [on] how a real gangster should act.”

The defense’s case strategy proved faulty from the start – his lawyers called a number of bookmakers to swear that Capone lost a lot of money betting on horse races. Their reasoning was that perhaps Capone’s gambling losses might excuse his tax bills, which made no sense. Deductions from losses are permitted only for taxes owed on winning wagers.

The first Capone witness, a cigar dealer who also accepted handbook wagers, praised the gang leader as a reliable horse race bettor, risking $1,000 to $5,000 a pop on horses from 1924 to 1925. However, Capone had no luck with the horses, losing from $8,000 to $10,000 in 1924 and as much as $12,000 the next year. A handful of other defense witnesses made the same point – Capone lost large sums at the track: more than $217,000 (equal to $3.9 million in 2021) from 1924 to 1927. Not one of them could name a single time Capone won a bet. The news prompted famous journalist Damon Runyon to quip that he had given the award of “world’s worst horse player to Mr. Alphonse Capone.”

Taking a different tack, the Capone defense called two illustrious men to the stand: Elmer Irey, head of the Treasury’s Intelligence Unit, which started the Capone investigation, and one of the prosecutors, Assistant U.S. Attorney Green himself.

Irey testified that his unit began probing Capone’s finances on October 18, 1928. He acknowledged that a court had sentenced Capone to serve 11 months in prison from 1929 to 1930 on a concealed weapon conviction.

In answer to Capone lawyer Albert Fink, Green volunteered that Capone’s ex-lawyer Mattingly testified before the grand jury that indicted Capone on the tax charges. But when Fink then argued the defense must be allowed to read Mattingly’s testimony to see if it was consistent with the notorious letter, prosecutors objected, stating that grand jury proceedings had to remain secret. Wilkerson agreed with the prosecution, which did not cross-examine the witnesses.

With that, Fink rested Capone’s defense. Fink hoped to bruise the government’s case with the jury by raising uncertainly about Mattingly’s letter to spark reasonable doubt. Again, he asked Wilkerson for a directed not guilty verdict and claimed that Irey’s testimony that the investigation began in 1928 meant a three-year statute of limitations had expired. Wilkerson again rejected his plea.

With that, the prosecution summed up its case to jurors. Grossman stated that the government proved Capone spent $40,000 in 1927 and $86,000 in the next two years, and that the gangster’s own witnesses claimed he wagered more than $200,000 from 1924 to 1927.

“Who is this man and where did he get his money?” Grossman asked. “You have the high privilege of putting the stamp of disapproval on the whole Capone organization and the conduct of the defendant.”

Then his colleague Clawson reminded the jury that the Mattingly letter described how Capone earned $266,000 in income from the mid- to late-1920s, but he never filed an income tax return.

Michael Ahern, for the defense, offered the jury a strange literary analogy – he compared the federal government’s crusade to get Capone to what the Ancient Roman statesman Cato the Elder once said: “Carthage must be destroyed!”

Fink then rose to insist the prosecution had not presented “a scintilla of evidence that [Capone] made a dollar,” only that he bought things, from 1924 to 1928, and that the checks signed by Guzik to buy furniture could have been loans. He said the defense had revealed how Capone, right after his release from prison in 1929, did attempt to pay his income tax.

“How in the world can you find him guilty of willful intent to defraud the government [that year]?” he asked, adding that prosecutors took aim at his client “merely because his name is Al Capone.”

Fink admonished the jurors to “not be swayed by the argument that the defendant is a bad man. He may be everything he is said to be, but do not for that reason find him guilty of something of which he has not been proven guilty.”

On October 17, the trial’s last day ended with the prosecution’s rebuttal. U.S. Attorney George E.Q. Johnson requested the jury to “draw your own conclusion” about where the cash originated to pay for the money orders that enriched Capone. In answer to Fink’s summation, Johnson made perhaps the most enduring statement of the tax evasion trial of the infamous leader of a violent Chicago crime group who had served so little time behind bars.

“Future generations will not remember this case because of the name Alphonse Capone, but because it will establish whether or not a man can go so far beyond that law as to be able to escape the law,” Johnson said.

The judge excused the jury for deliberations at 2:40 p.m. They took eight hours to reach a verdict. It was almost 11 p.m. Capone, in his room at the Lexington Hotel, dashed to the court, and at first received relieving news. The verdict came in “not guilty” for the single felony tax evasion count in the first indictment for tax year 1924. The jury found him guilty of a felony charge for evading taxes in 1925, but not guilty on three misdemeanor charges. Jurors ruled the same for 1926 and 1927 – guilty of a felony on count one, not guilty on the lesser counts.

Finally, the panel found him innocent of felony evasion for tax years 1928 to 1929, but guilty of two misdemeanor allegations of willfully failing to file tax returns.

The jury’s peculiar result in total rendered Capone not guilty on 17 of the 23 charges. But their guilty verdicts on the three felonies carried a maximum sentence of five years in prison and a $10,000 fine each, and up to one year in county jail and a $10,000 levy for each of the misdemeanors.

Capone stood before Wilkerson for sentencing on October 24. The judge gave him the maximum five years in federal prison and a $10,000 fine on the first felony conviction. However, Wilkerson allowed for the five years on the second felony to run concurrently with the first, meaning only five years total.

Then he dropped the bomb. Capone had to serve the five-year term on the third felony consecutively, essentially creating a 10-year prison sentence. He granted one misdemeanor conviction to run alongside the first felony sentence, but then ordered Capone – after serving the federal prison time – to do one year in jail for the remaining misdemeanor count, and then six additional months on a contempt of court conviction. The bottom line was 10 years in the federal pen, one and a half years county jail time. If Capone won on appeal for the felony convictions, he would still have to serve the jail sentence. He also had to pay $50,000 in fines and court costs (nearly $900,000 today).

“I guess it’s all over,” Capone said to his hapless lawyers. “You done all you could.”

While being led away, Capone told news photographers: “Get enough, boys, you won’t see me for a long, long time.”

While in the Cook County jail for six months, awaiting transfer to federal prison, Capone resumed his duties as boss of the Outfit through messages to visitors – including Guzik, Murray “The Camel” Humphreys and, some claim, Lucky Luciano and Dutch Schultz. He also sent telegrams and made telephone calls.

Capone lost his appeals, first in the U.S. Circuit Court, then, in 1932, the U.S. Supreme Court. The government almost immediately transferred him to the federal prison in Atlanta, where he would enjoy special privileges, for a while. In 1934, to his violent objections, the feds put him, along with 52 others in Atlanta, on a special, barred, steel train and delivered him to the far-stricter federal slammer on Alcatraz Island outside San Francisco.

In 1939, with good behavior credits, and suffering from dementia due to untreated syphilis, Capone gained release after serving eight years. The government again put him on a train and drove him secretly to meet his family outside Gettysburg, Pennsylvania. In 1940, his family moved him to their estate in Florida, where he died of a heart attack on January 25, 1947, just days after his 48th birthday.

Feedback or questions? Email blog@themobmuseum.org